Blog

Entrepreneurs, Here’s Why You Need Estate Planning

14/02/2023

Article By: AAG Advisor

Share!

The good news: You probably have some type of estate plan. The bad news: It’s probably old and out of date – which could put your wealth transfer plans at risk. Here’s what you can do to update your estate plan and get back on track!

KEY TAKEAWAYS

- Many estate plans are old and have become outdated – which could mean risks.

- Assess changes in your financial situation and your business to help see if your estate plan needs updating.

- Focus on what you want to do with your assets – don’t get too hung up on attractive tax strategies.

If you’re like lots of business owners, you’re looking out for more than just the financial health of your company. You also want to take good care of your family and other loved ones by providing for them and helping set them up for rewarding lives of their own.

That’s a big reason why estate planning is vital for successful entrepreneurs who want to make certain that after their passing, their heirs and others have the financial resources they need to move ahead successfully in life.

At its core, estate planning is a process for how you transfer your wealth. When it’s done carefully and thoughtfully, estate planning can enable you to pass on your assets as you see fit – while minimizing the state and federal tax bills that often go along with the transfer of sizable wealth.

Chances are, you’re aware of that – and you may even have implemented an estate plan. But if you think that your current estate plan is set up to accomplish those tasks, you might want to think again.

Here’s why your estate plan may need to be revisited and revitalized – and, if so, how to make it happen.

Old and outdated

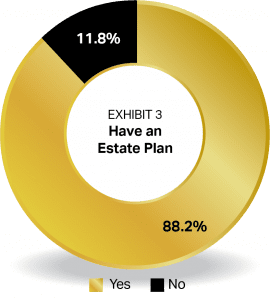

On the surface, it would seem that successful business owners are in good shape when it comes to planning for the eventual transfer of their estates. Consider that nearly nine out of ten business owners surveyed have an estate plan in place – which is defined as having, at a minimum, a will (see Exhibit 3). Having at least a will should help your loved ones avoid a great deal of trouble and stress when you pass on.

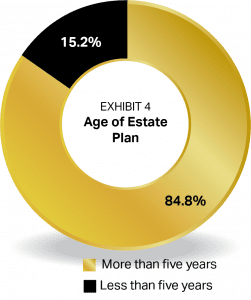

Unfortunately, a closer look reveals some troubling news: Entrepreneurs may not be nearly as well-prepared for wealth transfer as they think they are. Why? Because, we find, that approximately 85 percent of the estate plans that successful business owners have in place are more than five years old (see Exhibit 4).

N = 262 successful business owners. Source: Russ Alan Prince and John J. Bowen Jr., Becoming Seriously Wealthy, AES Nation, 2017.

N = 231 successful business owners who have estate plans. Source: Russ Alan Prince and John J. Bowen Jr., Becoming Seriously Wealthy, AES Nation, 2017.

That’s a potentially big problem – one that should raise a red flag that your plan could be outdated. Here’s why:

- Continual changes in tax laws mean that older estate plans may not take full advantage of current opportunities to transfer assets optimally.

- Tax law changes could mean that some aspects of an older estate plan are no longer valid or soon may not be valid.

- Changes in your company’s financial health and in your own wealth status mean that your estate plan may no longer accurately reflect your financial situation and your future needs and goals.

- Changes in your personal and family situation in recent years (marriages, divorces, deaths and the like) may make your estate plan ineffective in accomplishing what you now want it to do.

For example, consider that more than 60 percent of successful business owners report that they have become wealthier since they created their estate plans. Meanwhile, more than 75 percent say that they have experienced life-changing events since they created their estate plans.

These events – from divorce to the birth of children or grandchildren to the death of prospective guardians for minor children, and so forth – can have major impacts on planning for the future, and any existing estate plans.

The message is clear: It’s very likely that the current estate plans for a sizable number of successful business owners are outdated and ineffective. In order to attain the greatest benefits from estate planning, you need to stay on top of the matter and revise your estate plan when appropriate – especially as new events develop that potentially affect your company and your personal wealth.

Three examples of estate planning problems

When an estate plan is missing important elements or no longer reflects your wishes or your current situation, problems can quickly arise that may put your family’s financial future at risk. Consider these three examples:

- An affluent business owner dies without so much as a will. Suddenly, unknown relatives who live thousands of miles away appear and demand a share of the wealth – leaving the immediate family members and closest loved ones with far less. In the worst case, the company itself may need to be dissolved to pay for all the claims and taxes.

- A business has taken on new partners and stakeholders since the estate plan was first written. At the primary owner’s death, family members end up suing each other for control of the assets – and fighting over the future direction of the firm.

- An entrepreneur’s bright-eyed eight-year-old boy has grown up to become a drug-addicted 20-something. If the estate plan calls for him to receive a huge lump sum with no strings attached upon the entrepreneur’s death, he could burn through that money in no time. He even could potentially put his life at risk – if, for example, he uses the money to fund his dangerous lifestyle.

Getting current

So let’s say you’re among the roughly 85 percent of business owners with estate plans that are more than five years old. What steps should you take or consider taking?

Your first step should be to answer a few key questions, perhaps during a conversation with a trusted advisor or other professional:

- Has your financial situation changed since the estate plan was developed and implemented?

- Have your business interests changed, or have the people who are involved in your business changed, since that time?

- Has anything else changed in your life or the lives of people who might someday inherit your assets?

If the answer to any of those questions is “yes,” it’s probably time to update your plan in some way. As you move forward with that mission, there are some important issues to consider that will help you assess and rethink your existing estate plan.

Start by determining the ideal outcome or outcomes of an estate plan, in your eyes. Distributing your assets at death as you want them to be distributed must be the No. 1 driver behind any estate-planning decisions. Knowing what you want to have happen to your wealth is foundational.

Warning: Don’t over-focus on how you can cut your estate tax bill by the maximum amount possible. That’s a big mistake. Some strategies that enable maximum tax benefits often come with strings attached that require you to entirely cede control of the assets you want to transfer – an outcome that may be highly undesirable to you. Remember, the true goal of estate planning is to transfer your wealth in accordance with your wishes. Tax mitigation, while often very important and beneficial, should not be the overriding driver of your estate-planning decisions.

Armed with this information, consider issues such as:

- How you want any children to receive assets – in a lump sum, spread out over a period of years, etc.

- Whether to distribute assets using a fairness approach (each family member gets what he or she needs or deserves, as you see it) or an equalization approach (every family member gets the same amount of money regardless)

- Your succession plan for your business and how well it works with your larger estate-planning goals

- The existing documents you have in place – whether they are up to date and positioned as you want them

Pro tip: Documents that should be part of most estate plans include a basic will, trust documents, beneficiary forms for life insurance and investment/retirement accounts, durable power of attorney, health care power of attorney, living will (advance medical directive), inventory of assets, list of contacts (bankers, advisors, attorneys, etc.), list of passwords to email and other online accounts, and funeral arrangements.